Bookings and revenue are sometimes used interchangeably. This is not a trivial mistake to make. Conflating the two terms can give you a very wrong idea about how your business is doing.

Things get even crazier when it comes to forecasting. Organizations use forecasts to plan their course of action. This means the difference between booking and revenue forecasting is more than semantic. If the forecast is off (or forecasts the wrong thing), this can spell serious trouble.

We’re here to prevent that from happening. In this article, we’ll cover the differences between bookings, revenue, and show you how to forecast them correctly.

What is a Booking?

In the SaaS world, bookings are a forward-looking metric. It’s a commitment (in dollars) the customer makes to pay for your services over a period of time. Bookings are usually accompanied by a legal agreement.

In other words, the customer has “booked” your service for the duration of the contract. The value of the contract is measured in all the money you stand to make for the set period.

For example, your client signs a 12-month contract for $100 a month. The value of that booking would be $1,200.

Why are bookings important?

The number of bookings is a great way to figure out how well you are communicating the value of your product or service. If people are booking you a lot, this is a good sign your business is growing.

But don’t pop the champagne, yet. If you notice a sharp decrease in bookings, this may spell trouble a few months down the line.

What is Revenue?

Revenue is an accounting term and pertains to all the money you’ve earned from your customers. But there’s a catch. To keep things consistent, you want to recognize money coming in as revenue after you’ve provided the service.

Bookings are usually far more exciting than revenue. Bookings promise you a glamorous future (hopefully). Revenue keeps you grounded in the here and now.

Many organizations go about this all wrong. They recognize all incoming money as revenue. If they get lots of pre-payments, this artificially inflates their numbers and creates needless volatility. It can also be illegal to do that because Revenue recognition is regulated by accounting principles and/or laws. In the US, for example, most companies are required to follow GAAP rules. So, to get around this, recognize revenue once you’ve provided the service.

Let’s get back to our example from above. Say the client pays you the whole sum of $1,200 for the entire year. Does that mean you recognize it as revenue for the month of the deal? No. The proper and GAAP compliant way to do it is to recognize the revenue on a monthly basis once you’ve performed the service. This means $100 a month for the entire year.

In other words, you don’t count something as revenue until both sides have held up their end of the bargain.

Why is revenue important?

Revenue can be a very effective gauge of how your business is doing right now. If it’s recognized properly, that is. If you only rely on bookings, you may get very inflated numbers that don’t tell the whole story.

For example, bookings may paint a great financial picture. If you closed a bunch of deals this month, things may seem great. However, if the actual revenue coming in is barely enough to keep the lights on, you may have a cash flow problem. Looking only at bookings conceals this problem. Revenue reveals it.

Knowing the difference between revenue and bookings is only half the battle. The other half is forecasting each one of them effectively.

How to Perform a Booking Forecast

Coming up with a working forecast model for bookings is not difficult. But it requires a lot of number crunching and digging around the CRM.

There are three main models you can try:

1. Basic forecasting – this one is the simplest method that will need the least amount of work. But it’s also the least reliable. You basically aggregate the pipeline based on CRM and close date.

Pros: simple, relatively quick, relatively easy to pull off

Cons: limited, not as reliable as the other models in the list

2. Weighted pipeline – this model weighs amount of opportunity based on the probability of closure. It then adds all the weighted amounts together to get the size of the pipeline. It’s where things get more technical and require a lot more work.

Pros: reliable, accurate, uses a large data set to determine outcome

Cons: complicated, takes a lot of time without the proper software

There are multiple ways to perform weighted pipeline forecasting like

2.1 Weighted pipeline with static criteria: In this version of weighted pipeline, every opportunity is weighed based on its position in the pipeline i.e. probability associated with the deal stage a particular opportunity happens to be in.

2.2 Weighted pipeline with dynamic probability: Same as above but has one very significant difference. Instead of using static probabilities associated with the deal stage of the opportunity this type of forecasting model uses individualized probability for each deal. Individual probability can be configured

A. Dynamic Probability Fixed Criteria : Deal stage probability is calculated based on a predefined set of criteria. The closure probability is calculated by applying statistical methods like regression over historical data. Typical criteria includes:

-

-

-

-

-

-

- Rep history

- Size of deal

- Size of customer’s revenue

- Whether a deal is the first / only deal with the same account or follow-on deal

- Number of days left till the end of the quarter

-

-

-

-

-

Different companies choose to use a different set of criteria.

In this forecasting method, the probability of each deal (and hence overall pipeline) changes everyday.

B. Dynamic Probability Dynamic Criteria i.e. Predictive Forecasting: Same as above but instead of using fixed criteria, one uses advanced machine learning algorithms to automatically select the most significant criteria. This provides the most accurate measure of close predictability based on historical data. Doing this predicts the close probability and expected close amount of the deal.

3. Collaborative forecasting – by far the most complicated model of the bunch. This is a bottom-up booking forecast model suited for bigger sales teams. Each member of the team submits a forecast to their managers. The managers double check and often override the forecasts before moving them further up the ladder.

Pros: the most accurate model, goes through several filters along the way, good for both details and big picture thinking

Cons: takes a lot of resources, things can easily get messy if it’s not properly manage, difficult to pull off without assistance

Creating a booking forecast takes up lots of time and resources. If you’re not a fan of looking at the same old spreadsheets for hours on end, there are more elegant solutions on the market.

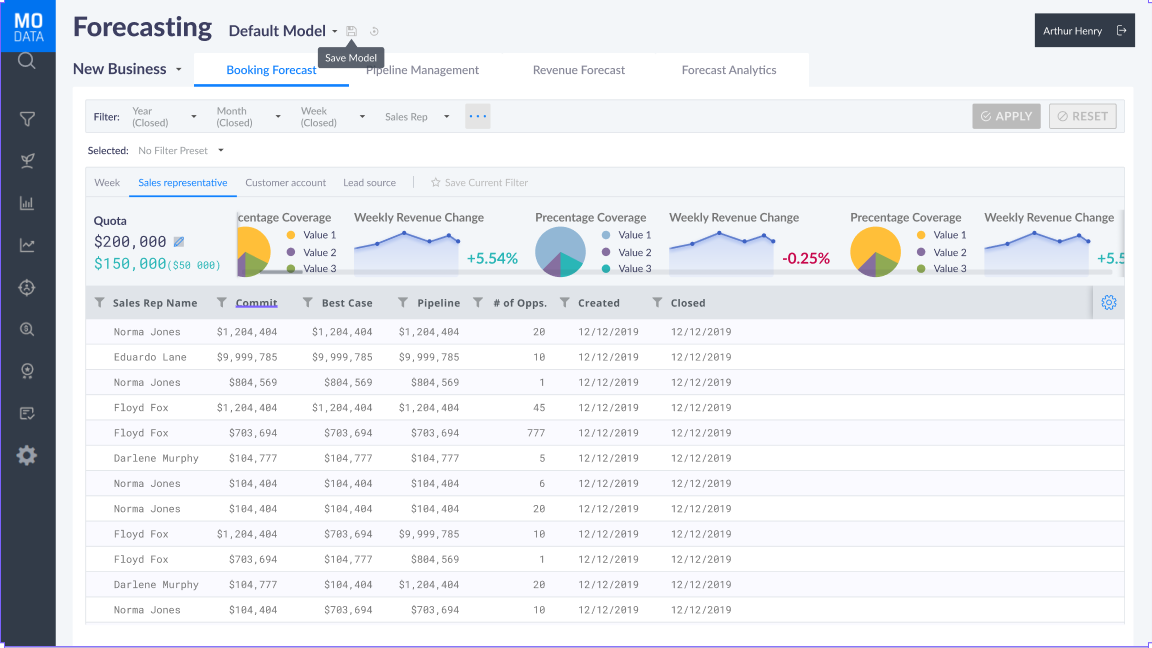

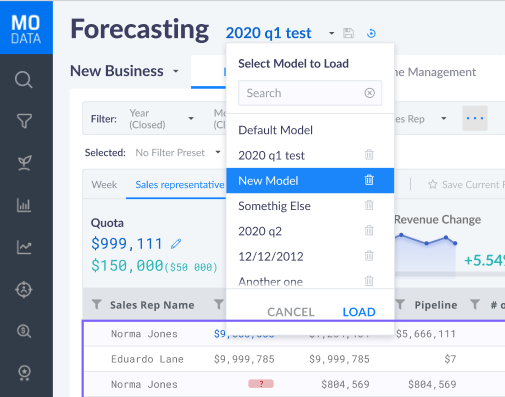

MoData offers functionality that automates these processes and allows you to create reliable forecasts more easily. With all the information at your fingertips, you save hours of tedious number crunching.

How can you perform a booking forecast with MoData

`

With MoData, you can still use any of the models from above. And, you can do it faster and a lot more efficiently. Let’s explore each of the options.

1. Basic forecasting

MoData allows you to use this model with a few simple clicks. Since the software is already connected to your CRM, you can easily aggregate the pipeline based on the CRM data and expected close date.

The process is near automatic and it will give you a reasonably accurate booking forecast. While this is the fastest model you can use, it is not the most accurate. But it’s ideal if you’re looking for a quick booking forecast and you don’t have the time to use any of the other models we offer.

2. Weighted pipeline

The weighted pipeline booking forecast model is more accurate but it requires more data and a pristine pipeline maintenance. Most importantly, from there on out, the system weighs every opportunity according to its position in the sales funnel. Usually based on the stages and stage probabilities.

Of course, the system also has the capability to dynamically calculate stage probability based on historical data. Both using a set of criteria, as well as by discovering the criteria using Machine Learning Algorithms. The software supports all the types of weighted probabilities we discussed above, so you get complete freedom to use it as you see fit.

This is where you’re probably thinking, “Well, hold on a minute. What if something changes during the process? What if our sales team knows something about the deal which can’t be represented in the CRM, but actually does affect deal probability? The system doesn’t account for such human element, does it?” Actually, it does.

For example, let’s say we have deal in the CRM which is about to close, i.e. it has 90% probability in CRM. But our sales rep finds out that our sponsor at the customer side is about to leave, hence the deal is not going to close. It’s very likely, but not set enough that deal should be moved to a lower stage in the CRM.

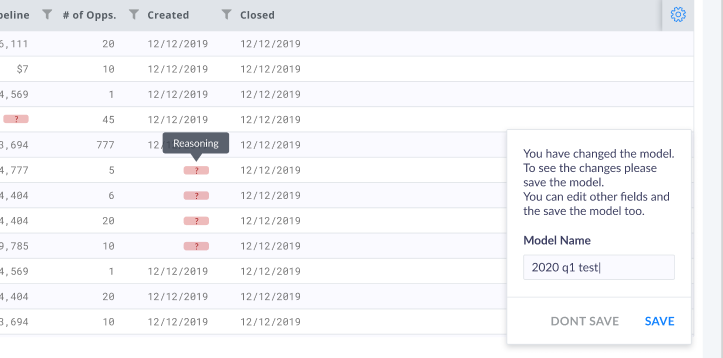

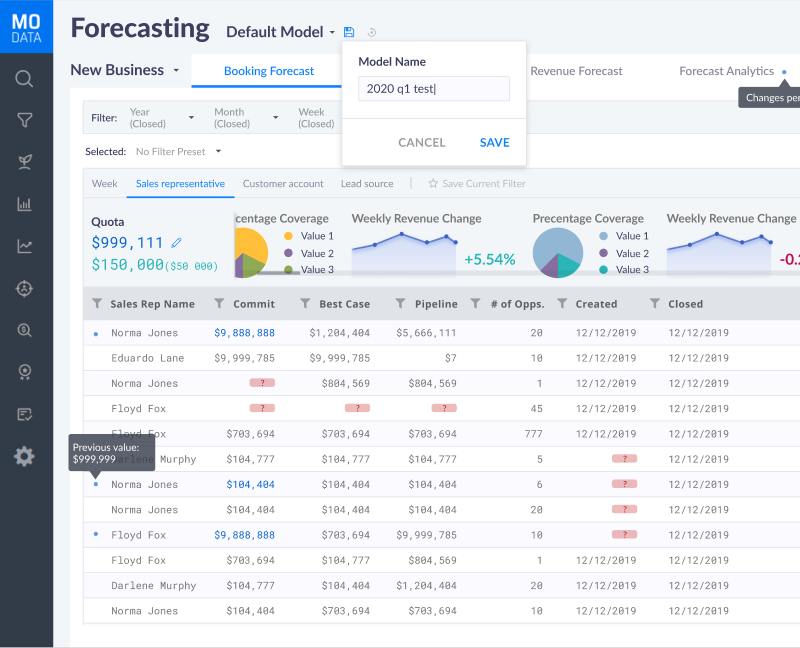

Such situations arise all the time. We understand that conditions may change at the drop of a hat, so we’ve built-in an override function for the rep/rep manager. In other words, whoever is using the system can use their better judgement to adjust the probabilities if they know there is a good reason for that.

If changes occur, the rep can go to the MoData UI and manually, with a few clicks adapt the probability without messing everything up in the CRM. It’s an elegant solution in an unpleasant situation. And it doesn’t contaminate the data so the general conclusions remain intact.

This functionality goes even further. You can add more than one probability to a single opportunity. This means you can play with various “what ifs” and come up with a model you think best works in that particular situation. All of this, without messing with the CRM and without confusing the rest of the team.

Finally, you can allow the system to make the prediction. The auto probability function uses machine learning and historical data to make a prediction for you.

3. Collaborative forecasting

The most complex model we’ll talk about today. Collaborative forecasting is excellent for bigger sales teams. But it can be messy. With so many people involved in forecasting process, without proper management, it’s bound to be chaos.

MoData offers the antidote. Our UI is simple to use and allows every member of the team to submit forecasts. The manager can then compare the models and see if anything sticks out before moving them up the ladder.

The best part about using MoData is that each team member can make several different models and then decide which one to send. Essentially, you can combine all three methods and come up with a much more accurate forecast.

In fact, we’ve had clients reporting a forecast accuracy of over 90% within two months of using the system.

Now you know how you can achieve an accurate booking forecast. This is important because the booking forecast will factor into the revenue forecast.

How to Perform a Revenue Forecast

Revenue forecasts are more difficult to perform than booking forecasts. It follows the formula below:

Revenue Forecast = Booking Forecast Based Revenue + Scheduled Revenue

Let’s unpack this formula.

What is booking forecast based revenue?

Booking forecast is the amount of revenue you are expected to generate based on deals in your pipeline. We’re looking at the deals that are likely to close i.e. the opportunities which haven’t closed yet.

We have discussed booking forecasting in previous sections already. However that process generally covers total size of the opportunity over the life of the deal (or at best annual revenue expectations), which does not answer the question you really trying to answer for revenue forecasting

“How much revenue we are expected to generate, per month/quarter, with all the open deals in my pipeline based on their forecasted close date and forecast TCV?”

While booking forecast based revenue is heavily informed by the booking forecast, it can’t directly be used for this purpose. It’s more of a starting point. One needs to refine the number in following ways:

- Add “time scale” to the estimated total contract value and forecast how much monthly/quarterly revenue is expected to generate from all the deals in the pipeline (based on their respective close probability and close date).

- Add one time payments you are expected to earn from customer plus their first period payment.

In other words, Booking forecast answers the question:

“How much total revenue we are expected to generate if the particular deal closes in a particular quarter for a particular amount?”

Booking Forecast based revenue answers the question:

“If a particular deal closes, how much revenue will we make each month for the life of the deal?”

What is scheduled revenue?

Scheduled revenue is the revenue coming in from past deals. For example, you’ve closed a deal for 12 month for $12,000, which means $1,000 a month. This means when you’re calculating your revenue forecasting, you include $1,000 from this deal, not the entire amount.

Revenue forecasting may seem simple at the surface level but once you start doing it, you realize how deep the rabbit hole goes. You need to break every deal into equal payments and perform complex calculations. With MoData, you can do all that with a few clicks. The software can distribute the revenue of a deal across its lifetime, making the creation of a revenue forecast that much easier.

How can you perform a Revenue forecast with MoData

MoData allows you take the value of the deal in the CRM and spread out over a period of time. You can do that both to the booking revenue and scheduled revenue. We allow you to add one time payment, delivery based payment (common in services company) and many other possible combinations. We have worked tirelessly to support multiple revenue forecasting models.

To take it a step further, the system supports multiple “what if” models. What this means is, you can set up different parallel scenarios in the system without messing up all the data. You can change different parameters in real time and see how exactly they are going to affect your end-of-quarter results.

Conclusion

It’s important to know the difference between booking and revenue forecasting. They’re interconnected, but they are not the same thing. Knowing the difference and performing both forecasts well is important if you want to avoid a whole bunch of problems, from setting unrealistic expectations to cash flow problems.

MoData makes forecasting a lot easier. Check out other content on the blog. Don’t forget to sign up for a free demo and see for yourself how well the software works. If you would like to be updated about articles in the future, join the club and sign up for our newsletter.